Irs Extension Of 1031 Exchange Deadlines . Web as a result of the february 24, 2023 irs notice, those who meet the requirements will be given an extended general postponement deadline of. Web the extensions permit eligible persons who began an irc §1031 exchange between november 24, 2022 and january. Web the extension applies to those who started a 1031 exchange between november 24, 2022 and january 8, 2023. Web section 1031 of the internal revenue code requires that taxpayers acquire all replacement property by the earlier of 180 days from the sale of the relinquished. Web the extensions permit eligible persons who began an irc §1031 exchange between november 24, 2022 and january.

from serightesc.com

Web the extension applies to those who started a 1031 exchange between november 24, 2022 and january 8, 2023. Web as a result of the february 24, 2023 irs notice, those who meet the requirements will be given an extended general postponement deadline of. Web section 1031 of the internal revenue code requires that taxpayers acquire all replacement property by the earlier of 180 days from the sale of the relinquished. Web the extensions permit eligible persons who began an irc §1031 exchange between november 24, 2022 and january. Web the extensions permit eligible persons who began an irc §1031 exchange between november 24, 2022 and january.

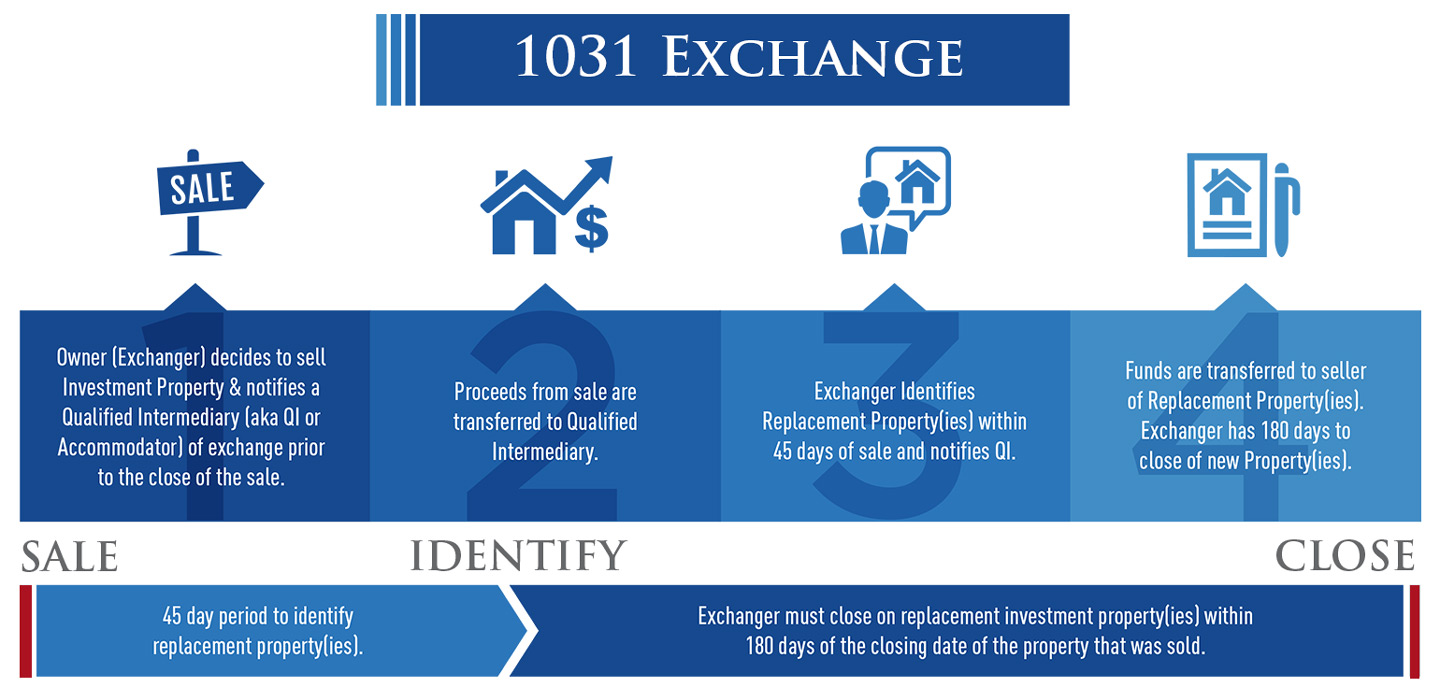

IRC §1031 Exchange Seright Escrow Inc. Services

Irs Extension Of 1031 Exchange Deadlines Web section 1031 of the internal revenue code requires that taxpayers acquire all replacement property by the earlier of 180 days from the sale of the relinquished. Web the extensions permit eligible persons who began an irc §1031 exchange between november 24, 2022 and january. Web the extensions permit eligible persons who began an irc §1031 exchange between november 24, 2022 and january. Web as a result of the february 24, 2023 irs notice, those who meet the requirements will be given an extended general postponement deadline of. Web the extension applies to those who started a 1031 exchange between november 24, 2022 and january 8, 2023. Web section 1031 of the internal revenue code requires that taxpayers acquire all replacement property by the earlier of 180 days from the sale of the relinquished.

From www.1031specialists.com

1031 Exchange Deadlines and Extensions Staying Compliant Irs Extension Of 1031 Exchange Deadlines Web as a result of the february 24, 2023 irs notice, those who meet the requirements will be given an extended general postponement deadline of. Web the extension applies to those who started a 1031 exchange between november 24, 2022 and january 8, 2023. Web section 1031 of the internal revenue code requires that taxpayers acquire all replacement property by. Irs Extension Of 1031 Exchange Deadlines.

From tonkon.com

1031 Exchange Deadlines Extended for Disaster Relief Irs Extension Of 1031 Exchange Deadlines Web the extension applies to those who started a 1031 exchange between november 24, 2022 and january 8, 2023. Web the extensions permit eligible persons who began an irc §1031 exchange between november 24, 2022 and january. Web the extensions permit eligible persons who began an irc §1031 exchange between november 24, 2022 and january. Web section 1031 of the. Irs Extension Of 1031 Exchange Deadlines.

From cbriancpa.com

What you need to know about the IRS extension of tax deadlines C Irs Extension Of 1031 Exchange Deadlines Web section 1031 of the internal revenue code requires that taxpayers acquire all replacement property by the earlier of 180 days from the sale of the relinquished. Web the extensions permit eligible persons who began an irc §1031 exchange between november 24, 2022 and january. Web as a result of the february 24, 2023 irs notice, those who meet the. Irs Extension Of 1031 Exchange Deadlines.

From 1031-exchange-rules.com

Irs 1031 Exchange 200 Rule 1031 Exchange Rules 2021 Irs Extension Of 1031 Exchange Deadlines Web section 1031 of the internal revenue code requires that taxpayers acquire all replacement property by the earlier of 180 days from the sale of the relinquished. Web the extensions permit eligible persons who began an irc §1031 exchange between november 24, 2022 and january. Web the extensions permit eligible persons who began an irc §1031 exchange between november 24,. Irs Extension Of 1031 Exchange Deadlines.

From www.linkedin.com

IRS Issues 1031 Deadline Extensions for Florida Irs Extension Of 1031 Exchange Deadlines Web the extension applies to those who started a 1031 exchange between november 24, 2022 and january 8, 2023. Web as a result of the february 24, 2023 irs notice, those who meet the requirements will be given an extended general postponement deadline of. Web the extensions permit eligible persons who began an irc §1031 exchange between november 24, 2022. Irs Extension Of 1031 Exchange Deadlines.

From studyschoolmattie.z21.web.core.windows.net

Irs Section 1031 Exchange Rules 2022 Irs Extension Of 1031 Exchange Deadlines Web the extension applies to those who started a 1031 exchange between november 24, 2022 and january 8, 2023. Web as a result of the february 24, 2023 irs notice, those who meet the requirements will be given an extended general postponement deadline of. Web the extensions permit eligible persons who began an irc §1031 exchange between november 24, 2022. Irs Extension Of 1031 Exchange Deadlines.

From www.youtube.com

1031 Exchange IRS Tax Form 8824 Explained YouTube Irs Extension Of 1031 Exchange Deadlines Web the extensions permit eligible persons who began an irc §1031 exchange between november 24, 2022 and january. Web the extension applies to those who started a 1031 exchange between november 24, 2022 and january 8, 2023. Web as a result of the february 24, 2023 irs notice, those who meet the requirements will be given an extended general postponement. Irs Extension Of 1031 Exchange Deadlines.

From www.ipx1031.com

LAST MINUTE IRS Extension Notice 1031 Deadlines in CA IPX1031 Irs Extension Of 1031 Exchange Deadlines Web section 1031 of the internal revenue code requires that taxpayers acquire all replacement property by the earlier of 180 days from the sale of the relinquished. Web the extensions permit eligible persons who began an irc §1031 exchange between november 24, 2022 and january. Web the extensions permit eligible persons who began an irc §1031 exchange between november 24,. Irs Extension Of 1031 Exchange Deadlines.

From www.youtube.com

IRS Extends the 45 and 180Day Deadlines for 1031 Exchanges for Irs Extension Of 1031 Exchange Deadlines Web the extensions permit eligible persons who began an irc §1031 exchange between november 24, 2022 and january. Web section 1031 of the internal revenue code requires that taxpayers acquire all replacement property by the earlier of 180 days from the sale of the relinquished. Web the extensions permit eligible persons who began an irc §1031 exchange between november 24,. Irs Extension Of 1031 Exchange Deadlines.

From 1031-exchange-rules.com

1031 Exchange Rules Irs 2021 1031 Exchange Rules 2021 Irs Extension Of 1031 Exchange Deadlines Web the extensions permit eligible persons who began an irc §1031 exchange between november 24, 2022 and january. Web the extension applies to those who started a 1031 exchange between november 24, 2022 and january 8, 2023. Web the extensions permit eligible persons who began an irc §1031 exchange between november 24, 2022 and january. Web section 1031 of the. Irs Extension Of 1031 Exchange Deadlines.

From www.linkedin.com

Julie Bratton on LinkedIn BREAKING NEWS IRS Extension of 1031 Irs Extension Of 1031 Exchange Deadlines Web as a result of the february 24, 2023 irs notice, those who meet the requirements will be given an extended general postponement deadline of. Web the extension applies to those who started a 1031 exchange between november 24, 2022 and january 8, 2023. Web the extensions permit eligible persons who began an irc §1031 exchange between november 24, 2022. Irs Extension Of 1031 Exchange Deadlines.

From blog.chicagoland1031exchange.com

IRS Announces Extended Exchange Deadline for Investors Chicagoland Irs Extension Of 1031 Exchange Deadlines Web the extensions permit eligible persons who began an irc §1031 exchange between november 24, 2022 and january. Web the extensions permit eligible persons who began an irc §1031 exchange between november 24, 2022 and january. Web as a result of the february 24, 2023 irs notice, those who meet the requirements will be given an extended general postponement deadline. Irs Extension Of 1031 Exchange Deadlines.

From quizzzonekoertig.z13.web.core.windows.net

Example Of 1031 Exchange Irs Extension Of 1031 Exchange Deadlines Web the extensions permit eligible persons who began an irc §1031 exchange between november 24, 2022 and january. Web the extensions permit eligible persons who began an irc §1031 exchange between november 24, 2022 and january. Web section 1031 of the internal revenue code requires that taxpayers acquire all replacement property by the earlier of 180 days from the sale. Irs Extension Of 1031 Exchange Deadlines.

From www.zrivo.com

1031 Exchange Rules 2024 Irs Extension Of 1031 Exchange Deadlines Web the extensions permit eligible persons who began an irc §1031 exchange between november 24, 2022 and january. Web as a result of the february 24, 2023 irs notice, those who meet the requirements will be given an extended general postponement deadline of. Web the extension applies to those who started a 1031 exchange between november 24, 2022 and january. Irs Extension Of 1031 Exchange Deadlines.

From www.jrw.com

Introduction to the 1031 Exchange JRW Investments Irs Extension Of 1031 Exchange Deadlines Web the extension applies to those who started a 1031 exchange between november 24, 2022 and january 8, 2023. Web as a result of the february 24, 2023 irs notice, those who meet the requirements will be given an extended general postponement deadline of. Web the extensions permit eligible persons who began an irc §1031 exchange between november 24, 2022. Irs Extension Of 1031 Exchange Deadlines.

From www.youtube.com

1031 Exchange Deadlines YouTube Irs Extension Of 1031 Exchange Deadlines Web the extensions permit eligible persons who began an irc §1031 exchange between november 24, 2022 and january. Web as a result of the february 24, 2023 irs notice, those who meet the requirements will be given an extended general postponement deadline of. Web the extensions permit eligible persons who began an irc §1031 exchange between november 24, 2022 and. Irs Extension Of 1031 Exchange Deadlines.

From serightesc.com

IRC §1031 Exchange Seright Escrow Inc. Services Irs Extension Of 1031 Exchange Deadlines Web as a result of the february 24, 2023 irs notice, those who meet the requirements will be given an extended general postponement deadline of. Web the extensions permit eligible persons who began an irc §1031 exchange between november 24, 2022 and january. Web section 1031 of the internal revenue code requires that taxpayers acquire all replacement property by the. Irs Extension Of 1031 Exchange Deadlines.

From therealdeal.com

Brokers, Attorneys Look to 1031 Exchange Extension Deadline to Spur Sales Irs Extension Of 1031 Exchange Deadlines Web section 1031 of the internal revenue code requires that taxpayers acquire all replacement property by the earlier of 180 days from the sale of the relinquished. Web the extensions permit eligible persons who began an irc §1031 exchange between november 24, 2022 and january. Web as a result of the february 24, 2023 irs notice, those who meet the. Irs Extension Of 1031 Exchange Deadlines.